PAN card is an important document for Indian taxpayers which is issued by the Income Tax Department of India. PAN (short for Permanent Account Number) is a 10 character alphanumeric identifier which is unique for every individual. As you may already know PAN card has several uses other than just being your identify document. Whether you need to file your income tax return (ITR), claim TDS refund, apply for a loan, or purchase an expensive item like a car, you will need your PAN card for these things.

It goes without saying that losing a PAN card can create huge problems for you especially when you are in a situation to use it for some urgent work. If you have lost your PAN card and you couldn’t find it anywhere, there is a ray of hope as you can still download the digital copy of your PAN card online. In this article, we will show you 3 different methods to download your e-PAN as a PDF file using NSDI, UTIITSL, and Income Tax Department websites. Later on, we will also cover some general FAQs about this topic. So let’s get started!

Table of Contents

What is e-PAN card?

e-PAN is simply the digital copy of your PAN card which is issued and digitally signed by the Income Tax department. It is downloaded as a PDF file. Apart from keeping e-PAN as a digital document file on your phone or PC, you can also print it out and use it in the form of a hard copy. If at any point of time you couldn’t find your original PAN card or it is lost somewhere, you can use your e-PAN as an alternative. e-PAN has all the details of your PAN card and it is considered equally valid.

Requirements for downloading e-PAN card

Here we have listed a few basic requirements and things you will need while downloading your e-PAN card online –

- Keep your PAN card and Aadhaar card numbers ready.

- Your Aadhaar card and mobile number must be connected with your PAN card.

- Make sure that your mobile number is active as you will receive an OTP on it for verification.

- Get your credit/debit card ready as you will need them to pay for the processing fee.

Download e-PAN card from income tax online portal

- Open Chrome or any other web browser on your phone/PC and visit the official Income Tax website.

- Under Quick Links section, find and click on “Instant E-PAN” option.

- Under “Check Status/ Download PAN” heading, click the Continue option.

- Now enter your Aadhaar card number and tap the Continue button again.

- You will receive an OTP (one time password) on your registered mobile number. Enter the OTP in the given field and confirm your identity.

- Upon successful verification, you will be able to download your e-PAN card from the income tax website. It will be downloaded as a PDF file. The file is protected with a password. Enter your date of birth to unlock the PDF and view your e-PAN card.

Download e-PAN card from NSDL online portal

- First of all, open any browser of your smartphone or PC and go to the official website of NSDL portal.

- You will be asked to enter your PAN card number, Aadhar card number and date of birth. There is one more field called GSTN which is optional to fill. If you have GSTN, you can add it in the given field or leave this option blank.

- After filling the correct information, enter the captcha as shown in the image and click on the Submit button.

- Now you will need to verify your identity through OTP verification. You can request OTP on your registered mobile number or email address. Click on “Generate OTP” button.

- Once you receive the OTP on your mobile number or email address, enter it in the required field on your screen. Validate the OTP and click on “Continue” button.

- You may be required to pay a small fee for downloading your e-PAN card. If your PAN application is submitted to NSDI and your PAN is allotted or changes are confirmed by ITD within 30 days, then no charges will be applied to you. On the other hand, if your PAN is allotted or changes are confirmed by ITD prior to 30 days, you will need to pay ₹8.26/- processing fee for downloading your e-PAN card.

- Select the payment gateway you want to use and complete the payment process. Upon successful completion of payment, click on the Continue option followed by clicking on “Paid e-PAN Download Facility”.

- Now you will be able to download the PDF of the e-PAN card on your phone or laptop. Note that this PDF file will be password protected. You have to enter your date of birth as a password to open it.

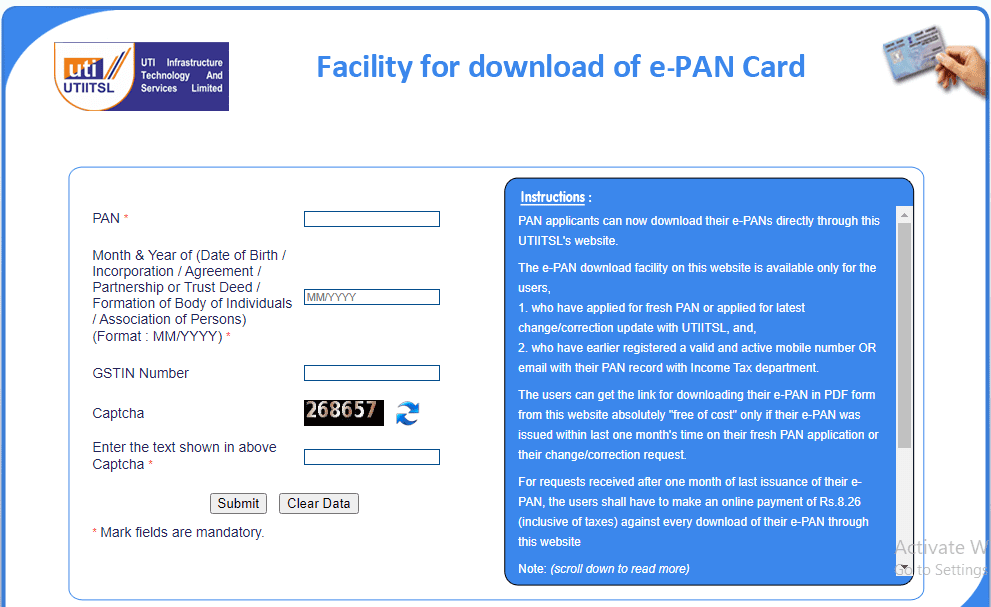

Download e-PAN card from UTIITSL online portal

- Visit the UTIITSL online portal on your phone or PC and click on “Download e-PAN Card”.

- Provide the details of your PAN card number, date of birth (MM/YYYY), and GSTN (optional).

- Verify the captcha by entering the text showing in the captcha image and then click on the “Submit” button to continue.

- In the next step, you will be asked to verify your phone number and email address. Check if the correct phone number and email is registered and enter the captcha again to verify.

- Select the mode of OTP verification and agree to the terms and conditions. Tap the “Get OTP” button and then you will receive an OTP on your selected mode. Enter that OTP in the given field and verify it. Next, you have to go through the payment process to pay for the processing fee.

- Once you have made the payment, you will be able to download the digital copy of your e-PAN card in the form of PDF file.

Frequently asked questions

Yes, you may be asked to pay the processing fee of ₹8.26 for downloading your e-PAN card. This processing is exempted for people whose PAN is allotted or changes are confirmed by ITD within 30 days.

The PDF file of your e-PAN card is protected with a password. You can enter your date of birth in the format of DDMMYYYY to unlock the PDF file.

The answer is yes. e-PAN is equally valid as your original PAN card and you can use it to attach anywhere. It is digitally signed and issued by the Income Tax department so it’s considered authentic. e-PAN also contains a QR code which has all demographic details of the PAN holder.

No. If you don’t have your Aadhaar card or mobile number linked with PAN card, you won’t be able to download e-PAN with just your PAN number. You are asked to provide your Aadhaar card and mobile number for the security verification purpose.

Final words

So that’s how you can download the digital copy of your e-PAN card online. We have shared three different methods for doing this. You can use any of them based on your preference. They are 100% genuine and official methods.

The websites of NSDI, UTIITSL, and Income Tax portal are managed by the government authorised agencies so you aren’t sharing your details with any third-party service.

If you are facing any problem in the above steps, feel free to share your queries in the comment section and we will help you out. Stay tuned with our website for more interesting tutorials.

Read other similar articles:

- How to Download Voter ID Card Online

- How to Download Aadhar Card (PDF) Online

- How to Download e-Driving License (DL) Online

- How to Check PAN-Aadhaar Card Link Status Online

- How to Check TDS Credit Online