To pay for advertising on Facebook, you need to add the details of your payment account to your personal account. The service rules state that only one advertising campaign can be paid for from one bank account.

The larger the advertising campaign, the more cards will be needed. For the convenience of users, services for issuing virtual cards have been created, through which you can quickly create accounts in any quantity. In this article, we will review the most reliable services and describe their main advantages.

Table of Contents

The advantages of virtual cards:

- In many services, there is an option to issue an unlimited number of cards for a single user. In Facebook, payment cards are considered consumables, so it is necessary to ensure in advance that there are a sufficient number of accounts to pay for all advertising campaigns.

- Blocking of bank cards usually occurs due to the use of an unreliable BIN (Bank Identification Number). Many services offer the ability to create them in large quantities and use a new card number for each advertising campaign, which helps avoid blocking.

- Instant card issuance. No need to wait for approval from the bank. In a matter of minutes, the card will appear in your personal account and will be ready for use.

- Services are tailored for traffic arbitrage and provide the ability to create teams, distribute roles among participants, and control the budget for each card.

- Simple account management. No need to open multiple personal accounts. You can change settings and view statistics from one account for all accounts.

- Complete anonymity and confidentiality of payments. No need to undergo identity verification or provide a passport.

Services with Virtual Cards

1. PSTNET

A modern and high-quality service that provides cards for payment on Facebook Ads, Google Ads, TikTok, and other advertising platforms. Virtual cards excel in paying for advertising, services, and goods worldwide.

- Quick registration (Google/Telegram/Apple ID/WhatsApp or email and password); the first card is available without documents (followed by a simple verification process).

- The largest number of premium BINs (US and European banks, 25+ BINs), making Risk Payment practically impossible.

- Multiple types of cards for different purposes with various conditions; there are cards with 3D-Secure (transaction confirmation via SMS code, codes sent to the personal account and Telegram bot).

- Responsive customer support.

- Convenient funding methods (BTC/USDT TRC-20 and 15 other coins, Visa/Mastercard, bank transfers SWIFT/SEPA); withdrawal in USDT is available.

- Advanced two-factor authentication system and a Telegram bot for service notifications.

- Functionality for Teams.

Advantages:

- Possibility to obtain free cards at no cost (with sufficient monthly spending);

- 0% transaction fees;

- 0% withdrawal fees from the card;

- 0% fees for declined payments;

- 0% fees for operations on blocked cards.

PSTNET offers the most advantageous conditions for subscribing to PST Private:

- 3% cashback on all advertisement spend

- Up to 100 free cards each month

- Only 3% top-up fee

- For now there is a 50% discount for the first month PLUS you don’t need to confirm your spend anyhow.

2. Brocard

Brocard virtual cards are suitable for working with Facebook and TikTok. Various tariffs, quick virtual card issuance, and funding options through fiat or cryptocurrency make this platform convenient. The reliability of payments is confirmed by the ability to conduct transactions with Google Ads, Meta, or other advertising promotion services.

This is an excellent indicator of Brocard’s suitability for Facebook advertising payments. The only downside is a complex registration process. To start using the service, you will need to undergo an interview with a Brocard representative.

3. Spendge

SPENDGE is a service that provides virtual card issuance for traffic arbitrage and other needs. The platform has been operating since 2021 and allows the issuance of an unlimited number of cards, including those with 3DS.

Virtual cards are issued instantly, and among the available currencies are euros and British pounds. These credit cards are well-suited for working with TikTok Ads, Facebook Ads, Google Ads, and other advertising platforms.

Features:

- Convenient functionality. All operations are conducted from a unified personal account, which is especially convenient for arbitrage teams.

- Report downloading. Reports on transactions or transaction history can be exported in CSV format.

- Flexible balance settings. Manage account balances and limits on issued credit cards.

4. LinkPay – The Best Virtual Cards in 2024

At the top of our list are the virtual crypto cards from LinkPay. The respected publication Payments Cards & Mobile refers to these cards as the best virtual cards in 2024, and it’s hard to disagree. Let’s take a look at what they offer.

- 3% cashback on all purchases

- 100 free virtual cards every month

- 0% deposit fee

- 0% on withdrawal fee

- 0% declined transactions fee

In other words, they don’t make money from the standard fees. Some services provide one or another feature from this list, but no one has yet combined them all into a single product.

LinkPay Offers a Variety of Virtual Cards

- There are cards designed for online shopping. You can easily pay for servers, hosting services, Steam, Netflix, Amazon, book hotels, buy plane tickets, and make any online payments – they work equally well everywhere.

- There are cards specifically for advertising expenses, three types in total: virtual cards designed for Facebook Ads Manager (actually reduce the chances of getting banned for Risk Payment), virtual cards specifically for Google Ads (also tested, likewise reduce the risk of being banned for Suspicious Payment Activity), and virtual cards for use across multiple platforms (can be linked to advertising accounts of all kinds: Google, Facebook, TikTok, Twitter, Bing, Taboola). Experts say these are the best solutions for paying advertising bills in 2024.

- There are convenient tools available for businesses and media-buying teams – enabling team management (inviting or removing members), setting limits on spending and card issuance capabilities, and controlling access to transaction history. Statistics can be viewed for all parameters, both for the team as a whole and for individual members.

Accepting Payments on Your Website

LinkPay is the first virtual card service that allows not only making payments online but also accepting payments on your website. The integrated payment acceptance service, named Merchant, enables the acceptance of both cryptocurrency (supporting hundreds of different crypto) and fiat currency (VISA / Mastercard in over 100 currencies worldwide). Local payment methods like P2P transfers are also available. According to the support service responses, this solution can be integrated via iframe or API, with the connection taking no more than an hour. Hence, the question, “How to accept payments on the website?” becomes obsolete. Importantly, the Merchant feature is accessible even under the free pricing plan.

5. Flexcard

FLEXCARD – virtual debit cards with unlimited issuance for Facebook, TikTok, Google, and other traffic sources. According to top arbitrageurs, it is a reliable payment service suitable for individuals and teams.

Features:

- Many reliable BINs. New ones are launched every 3-4 months.

- Unlimited fast issuance.

- Top-up fee – starting from 3.5%.

- Minimum top-up amount – $50.

- Convenient team functionality.

- Auto-replenishment.

6. 4×4.io

4×4.io is a service for issuing virtual banking cards for advertising payments on Google Ads, Facebook Ads, TikTok Ads, and other platforms. The service is available worldwide, and the accepted currencies include USDT, euros, and dollars. It offers sub-accounts, virtual and private bins, a tariff network, and 24/7 support.

Features:

- Exclusive virtual and private bins

- Official fully-functional app available on Google Play and App Store

- Full functionality for teams

- Agency accounts for partners

- Flexible tariff grid for partners

- Deposit replenishment with 0% commission

- Minimum deposit of $500

- Personal manager available 24/7

7. Karta.io

Karta.io is a financial operating system for electronic commerce established in 2019. The platform enables users to open accounts, issue virtual cards with trusted bins, and manage the finances of both companies and individual employees. Collaboration is possible with teams having a monthly turnover of $40,000 or more.

The service is suitable for team collaboration, providing the ability to set budgets for teams, projects, or individual advertising campaigns. Team leaders can establish specific rules for each team member, define roles, and set spending limits to prevent overspending. Team members can be grouped into budgetary brigades. All current advertising expenses will be reflected in real-time. Essentially, you replace cumbersome and error-prone manual accounting with a secure automated tool.

8. LeadingCards

LEADINGCARDS allows the issuance of cards from more than 12 issuers. It enables the issuance of cards in various GEOs, ensuring smooth payment processing for your company. Some of the service features include:

- Rapid issuance of cards in USD, EUR, or GBP, depending on your needs and goals.

- 24/7 technical support.

- Flexible terms and bonuses for loyal customers.

- The option to fund the wallet through Bitcoin, Visa, MasterCard, Paypal, or WireTransfer.

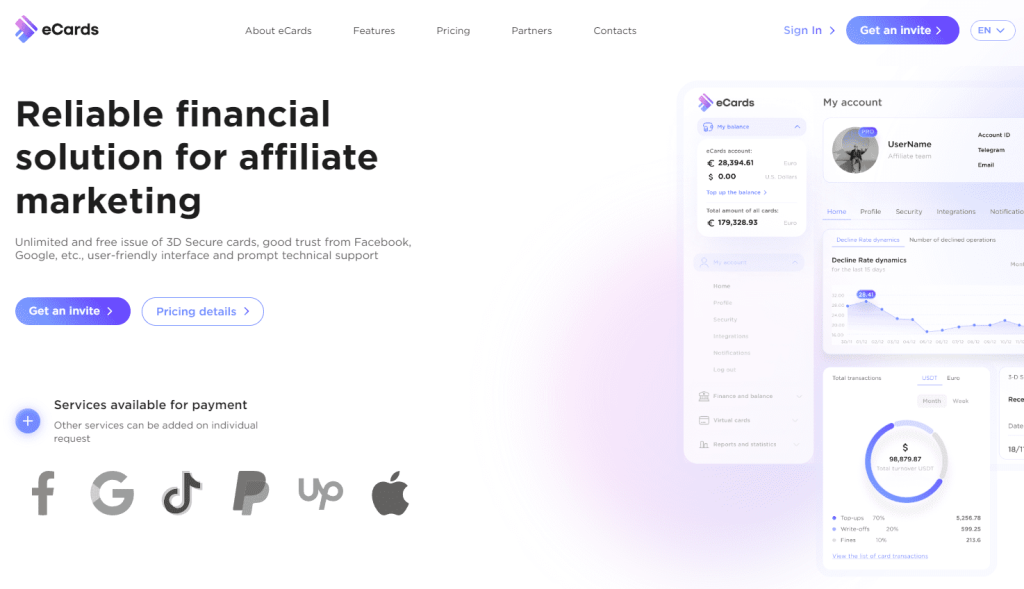

9. eCards

The virtual card service eCards.cab entered the market in 2020 and has since established itself as a reliable partner. Users receive cards in euros, allowing them to work with any convenient currency, with payments processed at the conversion rate of the international payment system.

eCards are suitable for most advertising platforms, including FB, TikTok, Google, and the Apple developer account. Access to other advertising platforms is available through an additional request. The only fee charged by the service is for balance replenishment, amounting to 4.5%. It is also worth noting that depending on your rating, there is a penalty system for rejected transactions, ranging from 0.2 to 0.5 euros.

Choosing the right service to obtain bank cards for advertising on Facebook plays a crucial role in the successful launch of advertising campaigns. Considering aspects such as security, available features, fees, and other terms of use, you will be able to optimize your operations and achieve greater profitability in your advertising campaigns.

Read other similiar articles:

- What is UPI 123Pay? How to Send Payments Without Internet

- 10 Places Where You Can Add AdSense Ads

- How to Fix Payment Method Was Declined on iPhone